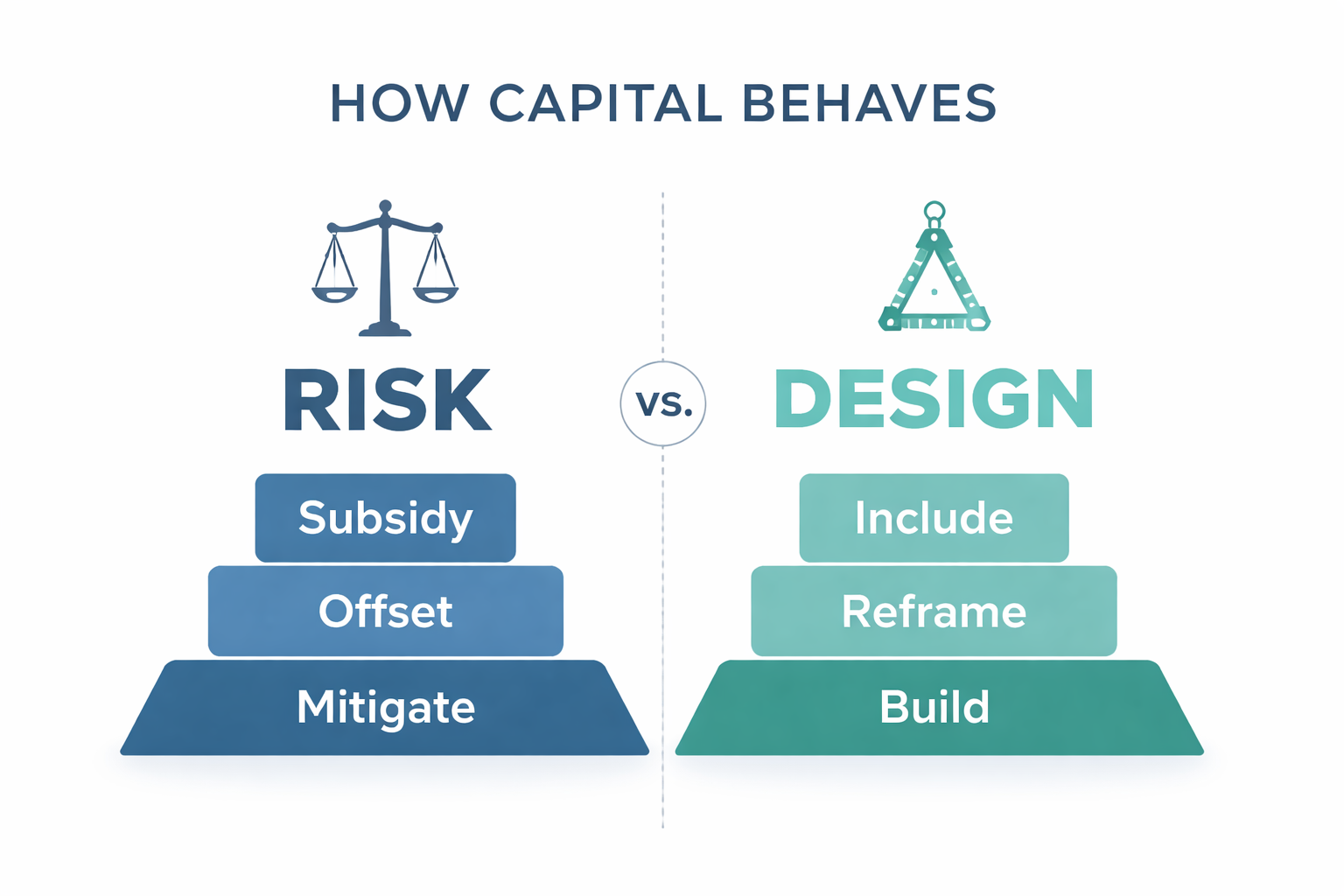

Finance keeps trying to fix peace and stability downstream. But fragility begins upstream — in how capital behaves.

The Real Problem

Finance has a peace problem. Not because it ignores peace, but because it keeps looking for it in the wrong place. Everywhere, the same claim repeats: peace reduces risk. It sounds self-evident — until you look closer.

Risk is already priced. It’s embedded in margins, guarantees, and credit ratings the moment a deal is signed. Risk lives downstream, in what might go wrong later. Peace, if it is real, lives upstream — in how we design the deal itself.

For this reason, those exploring the investing-in-peace space should realise that peace finance cannot be sold on risk reduction. Not because peace doesn’t matter, but because risk is the wrong object. Risk sits downstream of design. Peace finance, if it is to be credible, must sit upstream.

When peace is treated only as risk management, finance becomes dependent on permanent subsidy, insulating itself from volatility instead of addressing it. In that case, peace stays a cost centre, never a source of value.

Peace finance starts where risk pricing ends — at the design table.

The Illusion of Risk Management

Take almost any development or impact project today — a DFI-backed agribusiness, a climate-resilient infrastructure project, or a digital inclusion platform. Each claims to “reduce fragility” or “enhance resilience.”

In reality, most of these initiatives focus on protecting project performance, not strengthening the wider system on which that performance depends. They stabilise near-term cash flows but leave the structural fault lines of the market untouched.

A DFI may fund a solar park in a region with contested land rights. A “Do No Harm” review might ensure minimal displacement, add a grievance mechanism, or require a local-hiring clause — safeguards that mitigate harm rather than reframe how value and voice are distributed. Yet the underlying power dynamics — who controls access, who gains predictable income, who is excluded from decisions — remain unchanged.

The project may manage its reputational and operational risk, but it rarely alters the incentive structure that keeps those risks recurring. Fragility is managed, not resolved, and stability stays externally subsidised rather than internally generated.

If fragility isn’t redesigned out, it gets refinanced in.

The False Promise of Subsidising Risk

When finance encounters fragility, the instinct is to subsidise risk — through concessional capital, first-loss guarantees, or donor-funded technical assistance.

These tools are often essential, but only if the design logic itself changes. Otherwise, they reward the wrong behaviour — signalling that the riskier the context, the greater the cushion.

For example:

– A blended-finance facility channels concessional funds to cover early losses, yet keeps lending criteria unchanged. The subsidy shields investors, but no new trust or local capability is built.

– A fragility or resilience bond carries a donor-funded guarantee to attract private buyers, but its metrics remain tied to project completion and repayment, not to reduced volatility or social cooperation.

– A donor-backed SME fund in South Sudan enjoys credit protection but lends only to contractors in secure zones, effectively walling capital off from the very markets it claims to stabilise.

– A PeaceTech pilot receives innovation funding to digitise early-warning data but never integrates it into community decision-making — the grant lowers perceived delivery risk, not systemic risk.

Each of these examples lowers apparent risk because subsidy absorbs it, not because design removes it. They are safe for financiers — but not necessarily safe for peace or stability.

If the design logic never shifts, fragility keeps demanding public protection, creating a risk-subsidy trap that blocks self-sustaining stability. Using public funds through DFIs to protect private investors is not only unsustainable in a world of declining aid budgets; it also perpetuates the very dependence peace finance aims to end.

Concessional capital that insure behaviour never change behaviour.

From Inclusive Finance to Peace-Differentiated Finance

Inclusive finance expanded access, but inclusion alone doesn’t guarantee peace-positive outcomes — and is often not very inclusive at all.

Consider a microfinance institution that targets women, youth, or displaced populations. Access may increase, but if credit models replicate the same collateral requirements, repayment pressure, or intra-group inequities, tension can still deepen. In fragile markets, exclusion often occurs inside inclusion.

Peace-Differentiated Finance, on the other hand, asks not only who gains access, but how that access reshapes trust and relationships. Without that relational lens, inclusion risks reinforcing hidden hierarchies even within marginalised communities. With it, inclusion becomes cooperative: borrowers gain not just capital, but voice and predictability.

| Inclusive Finance | Peace-Differentiated Finance |

| Expands access | Expands cooperation |

| Measures outreach | Measures trust, inclusion, cooperation |

| Manages risk | Designs for peace |

| Focuses on beneficiaries | Focuses on relationships |

| Seeks neutrality | Seeks legitimacy |

When finance becomes peace-differentiated, it stops counting beneficiaries and starts measuring trust — the real currency of resilient markets.

Making Capital Behave

Making capital behave means changing how it interacts with society. Every fragile context hides an informal “risk calculus”: who is deemed bankable, who bears losses, who defines success. Peace-Differentiated Finance rewrites that calculus.

It introduces Peace-Enhancing Mechanisms (PEMs) — design features that operationalise trust, inclusion, and fairness. Examples include participatory governance in fund boards, transparent grievance systems, and benefit-sharing rules tied to cohesion outcomes.

Each mechanism is modest alone, but together they make capital predictable, fair, and inclusive. They replace subsidy dependency with trust dividends.

When capital behaves differently, volatility reduces from within the system. When it doesn’t, fragility remains externally managed — a permanent liability.

The next frontier isn’t financing peace projects — it’s financing peace behaviour.

How This Looks in Practice

Peace-Differentiated Finance becomes tangible when seen through the different actors who make — and move — capital. Each faces the same challenge from a different angle: how to embed peace not as narrative, but as design.

It’s not where the money goes, but how it behaves once deployed.

The following examples show what this looks like across the ecosystem — from DFIs and NGOs to PeaceTech innovators and social enterprises.

DFIs and Investors

Most DFIs already conduct fragility or conflict assessments but seldom translate these insights into structural design. A sustainability or gender bond may successfully channel capital to social or climate goals, but because it follows traditional output-based logic, it rarely transforms how benefits and risks are distributed within local economies.

A peace-differentiated structure embeds PEMs directly into its governance and term sheets. It uses concessional funding not to absorb losses, but to activate design reforms — transparent risk-sharing, joint oversight, and cooperative ownership models.

When DFIs change the design logic, risk pricing falls naturally — the stability dividend becomes real.

NGOs and INGOs

NGOs often hold the greatest legitimacy and trust at community level but rarely influence the financial architecture that governs risk and reward. A livelihood project can either breed dependency through short-term contracting or build ownership through shared governance and co-investment. Only one of those survives the project cycle.

If peace outcomes stay invisible, they stay uninvestable.

Peace-Differentiated Finance gives NGOs and implementing partners a way to demonstrate the tangible, investable value of their work — translating legitimacy, participation, and trust into measurable cooperation outcomes that can attract private capital to scale what works. Without this translation, aid keeps recycling fragility instead of resolving it.

PeaceTech Innovators

PeaceTech’s promise lies in turning cooperation into visible, verifiable data. But good intentions alone can backfire. There are precedents — algorithms that reinforced bias, mapping tools that exposed vulnerable groups, or data systems that improved reporting but deepened distrust on the ground.

A grievance-tracking app helps only if information loops back to those affected.

A fintech platform for displaced people builds trust only if ownership and consent are transparent.

Peace risk doesn’t sit in the data. It sits in your design logic.

PeaceTech’s next frontier is to design tools that don’t just function but foster trust — turning digital systems into infrastructure for measurable peace impact, not just instruments for data collection.

Social Enterprises

Local enterprises often embody peace-positive behaviour — equitable hiring, local sourcing, transparent governance — but struggle to prove it to investors.

Peace-Differentiated Finance makes this visible. By quantifying cooperation and trust outcomes, it converts social capital into investable capital.

Enterprises gain access to better terms; investors gain credible stability signals.

Peace-positive businesses don’t just operate in fragile markets — they make those markets less fragile.

If they don’t, they simply uphold the unequal status quo behind their inclusive claims.

Why This Matters Now

The global finance landscape is shifting. DFIs face scrutiny on measurable impact. Donors seek exits from endless subsidy. Tech innovators are under pressure to prove that how they build matters as much as what they build.

Peace-Differentiated Finance connects these dots, offering a design discipline that prevents risk through cooperative behaviour instead of compensating for it later.

Peace Finance makes behavioural shifts measurable. Because what gets designed can be priced — and what gets priced can scale.

If peace stays outside financial logic, fragility remains publicly funded and privately priced. Bring peace upstream, and stability becomes self-financing — through lower costs, stronger legitimacy, and shared accountability.

From Principle to Practice

PeaceFinance.org has developed a Test for Peace-Differentiated Design — a tool to examine whether peace is genuinely built upstream into project logic.

The next step is adapting it for each actor group:

| Actor | Test Focus | Example Questions |

| DFIs / Investors | Peace-Positive Structuring | Do risk-pricing models reward trust-building? Are PEMs part of the term sheet? |

| NGOs / INGOs | Peace-to-Finance Translation | Can peace results be expressed as investable indicators? |

| PeaceTech / Data Firms | Peace-by-Design Architecture | Does the technology embed fairness, consent, and accountability? |

| Social Enterprises | Peace-Value Proposition | Can stability outcomes be shown alongside financial performance? |

These tests will evolve through the new Peace Finance Workshop Series by PeaceFinance.org, helping participants apply peace-differentiated design to their own work — from capital deployment to technology development.

But the workshops are more than testing. They are meant to reconnect what is now a fragmented landscape — investors, NGOs, PeaceTech innovators, and enterprises each working in isolation. Through shared cases, reflection, and co-design, the workshops will help shape a common peace-finance language and build the connective tissue of a new ecosystem.

PeaceFinance.org exists to bring the actors of peace finance together — so that capital, technology, and community can finally speak the same design language.

The aim isn’t to make everyone financiers, but to make everyone designers of peace behaviour. That’s how accountability becomes market logic.

From Risk to Behaviour

If we want peace to be investable, we must stop treating it as a footnote to risk.

Peace is not a hedge — it’s a habit.

It’s not a moral claim — it’s a design discipline.

When capital behaves differently, outcomes follow. That’s what turns peace from an aspiration into an asset class.

On 10 March, PeaceFinance.org and The Hague Humanity Hub will host a Sneak-Peek Session introducing the upcoming Peace Finance Workshop Series.

If this article has sparked your interest — or inspired you to rethink how capital behaves — we warmly invite you to join us.

👉 Sign up here